Economic Update for 9-5-25

- Rudy Thomas

- Sep 5, 2025

- 2 min read

This morning we saw the release of the always-important Non-Farm Payrolls report for August. The report showed a disappointing net gain of only 22,000 jobs, significantly below the upwardly revised July figure of 79,000 and well under the forecast of 75,000 new jobs. However, June’s payroll level was revised downward, showing an actual decline of 14,000 employed workers. The primary bright spot for hiring remains the health-care sector, which added 31,000 jobs last month. A trend we have seen over the past several months is the continuation of job cuts in the Federal Government. August saw a decline of 15,000 workers in this area and we applaud the ongoing reduction due to spending cuts by this administration.

The somewhat disappointing payroll numbers were not a surprise. On Thursday, the ADP report on private-sector employment showed a gain of only 54,000 jobs for August, well below July’s 106,000 and trailing the forecast of 65,000. August marked the third weakest month in the past year. Several factors appear to be contributing to slower hiring, including tariff-related uncertainties and the disruptive effects of artificial intelligence on business operations and models. The growing role of technology in everyday business will likely remain a structural challenge for employment trends going forward.

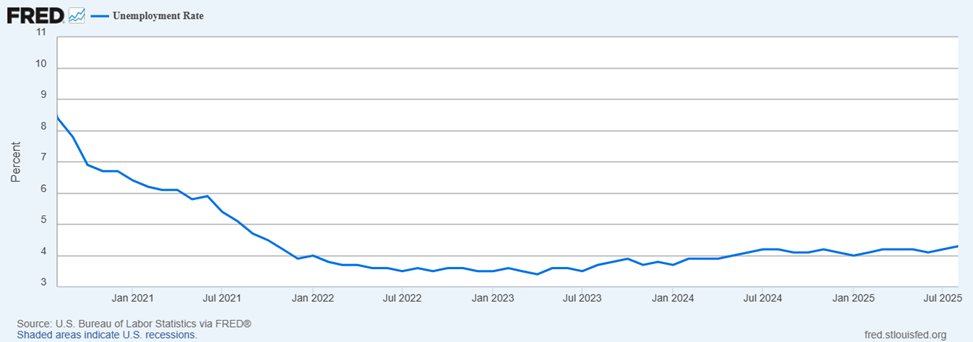

The unemployment rate for August ticked up to 4.3% from 4.2% in July. However, average hourly earnings remained relatively strong, rising 3.7% year-over-year. Average weekly hours held steady at 34.2, while the labor force participation rate edged higher to 62.3%. These comparisons are somewhat encouraging, despite the weaker headline jobs number.

Overall, while August’s employment data was softer than expected, it may provide the Federal Reserve with cover to begin cutting interest rates at its upcoming meeting on the 16th and 17th of this month. A 25 basis-point cut is still the most likely outcome, but these numbers raise the possibility of a larger half-point reduction. The next few trading days will likely be influenced by how markets anticipate the Fed’s decision.

We head into the weekend, and I hope you have fun plans lined up. And hopefully, another win for Nebraska, Go Big Red!